When you work with various stakeholders to accomplish your mission, it is extremely important to communicate with them effectively. Volunteers, funders, board members, staff, and other community members dedicate their hard-earned funds, time, and energy to your organization, so you must be transparent with them about your operations and impact.

One of the best ways to maintain transparency is to share your nonprofit’s financial statements. These documents not only help your team make informed financial decisions internally, but they also demonstrate to external stakeholders that you are using their funds responsibly, allowing you to gain their trust.

In this guide, we’ll provide a brief overview of the different types of nonprofit financial statements and then dive deeper into how each one enhances stakeholder communication and transparency.

What are the main nonprofit financial statements?

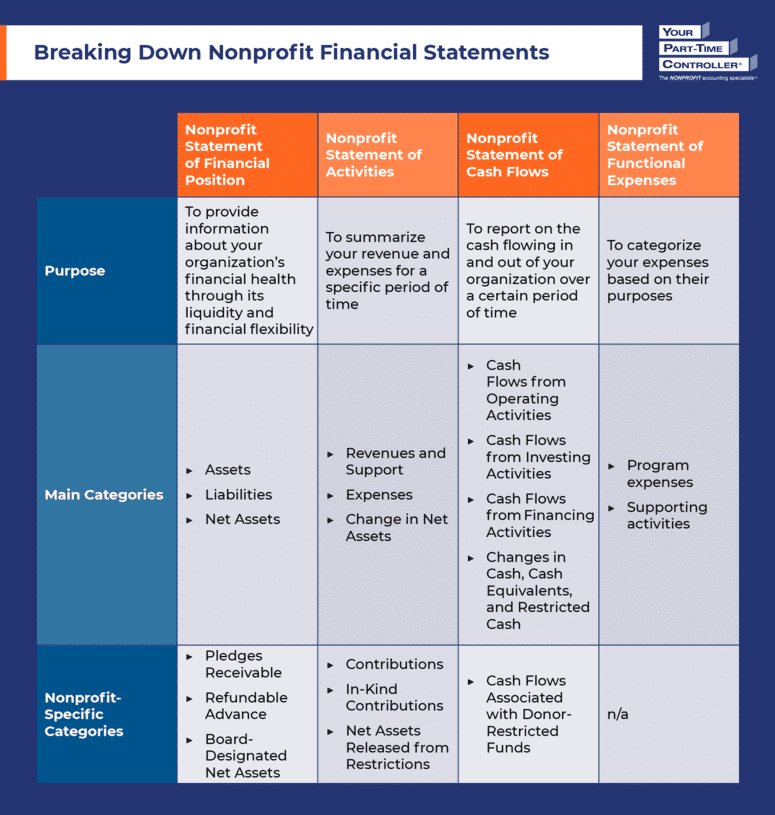

YPTC’s nonprofit financial statements guide explains the four following types:

- Statement of Financial Position. This document, also referred to as a balance sheet, demonstrates your organization’s financial health through its assets and liabilities. Ultimately, it allows you to determine your net assets, which indicates whether your nonprofit has a resource surplus or deficit.

- Statement of Activities. Also known as an income statement, the Statement of Activities reflects the overall financial performance of your organization during a specific period, usually your fiscal year. It includes the difference between the organization’s total revenues and expenses and represents the surplus or deficit for net assets with and without donor restrictions and the entity as a whole.

- Statement of Cash Flows. The Statement of Cash Flows captures how cash flows in and out of your organization within a certain period. It shows whether this cash comes from operating, investing, or financing activities and allows you to determine how much money your nonprofit has available to pay its expenses.

- Statement of Functional Expenses. This document breaks down your expenses into categories based on their function, such as major classes of program services and supporting activities. While nonprofits don’t technically have to create a separate financial statement to summarize this information, most choose to do so as it can help them complete their Form 990 more efficiently.

Under Generally Accepted Accounting Principles (GAAP), your nonprofit must provide the first three statements and also report information about its expenses by nature and function. You can provide information on your expenses on the face of your Statement of Activities, as a schedule in the notes of your financial statements, or in a separate Statement of Functional Expenses.

How does each nonprofit financial statement support stakeholder communication?

With a better understanding of the main nonprofit financial statements, we can now explore how each contributes to better, more transparent stakeholder communication.

Statement of Financial Position

This statement details your organization’s assets, liabilities, and net assets for a specific moment in time. Sharing this information with stakeholders can:

- Reveal your nonprofit’s financial health. Your nonprofit’s net assets represent your organization’s current financial health. This information can increase transparency and give stakeholders better insight into your nonprofit’s financial stability.

- Demonstrate responsible resource allocation. If your nonprofit has positive net assets, that is a sign that you’re allocating resources responsibly. Seeing this data can help donors feel at ease and encourage them to continue supporting your organization, therefore boosting donation revenue.

- Establish long-term viability. Elements of your Statement of Financial Position can show stakeholders that you are invested in your organization’s long-term success and sustainability. For example, you may report on board-designated net assets, which represent resources your board has set aside for future programs, investments, contingencies, or asset purchases.

Overall, your Statement of Financial Position provides a snapshot of your entity’s liquidity and financial flexibility.

Statement of Activities

Your nonprofit’s Statement of Activities focuses on your revenue and expenses, allowing your organization to:

- Communicate donors’ impact. Double the Donation’s donor stewardship guide recommends stewarding donors by updating them on “the specific initiatives you’ve allocated their donations toward, whether that’s a new program, supplies, a fundraising event, or something else entirely.” Your Statement of Activities helps readers understand how your organization manages its resources to fulfill its mission so they have a better sense of their donations’ impact.

- Show operational efficiency. Since this document demonstrates your ability to generate revenue and manage expenses, it shows how efficiently you are using the resources available to you. When you showcase high operational efficiency, you can instill confidence in donors, sponsors, program beneficiaries, and other stakeholders.

- Highlight different revenue streams. Unlike the for-profit version of this document, the nonprofit Statement of Activities reports on revenue from monetary donations and in-kind contributions in addition to programming and event income. As a result, you can show stakeholders that you are not relying on a singular funding source. This is especially important for forging partnerships with sponsors who may be more willing to support your organization if you can demonstrate financial stability through revenue diversification.

Additionally, your Statement of Activities indicates how you are using funds to fulfill your mission, keeping your organization accountable for upholding its guiding principles through its resource allocation.

Statement of Cash Flows

The Statement of Cash Flows is unique in that it reports how cash moves in and out of your organization. This document enables your organization to:

- Show its ability to meet short-term obligations. This information is especially beneficial for board members as it allows them to monitor your organization’s liquidity and make informed decisions about your nonprofit’s strategic planning and resource allocation.

- Reveal information about investment activities. External stakeholders likely aren’t aware of the investments your organization makes to support its operations. Being transparent about these investments can provide insight into how your nonprofit is strengthening its infrastructure and preparing for future growth.

- Demonstrate its financial flexibility. When your stakeholders see the amount of cash flowing into your organization, it can reassure them of your nonprofit’s capacity to handle financial challenges and remain stable against greater economic changes.

From short-term obligations to long-term investments, your Statement of Cash Flows shows stakeholders your organization is financially stable and sustainable.

Statement of Functional Expenses

This document details the nature and function of your expenses, which helps your organization to:

- Further break down its fund utilization. The Statement of Functional Expenses reports on program expenses (including costs directly related to your services and mission) and supporting activities (including management and general expenses, fundraising expenses, and membership development expenses). You’ll list each expense by its natural classification, such as personnel costs, professional services, office expenses, facility costs, and depreciation. This level of detail boosts transparency and trust with stakeholders and provides donors, sponsors, and beneficiaries more context on what it costs for your entity to sustain its programs and activities.

- Demonstrate the need for overhead expenses. Many donors are hesitant to support overhead expenses as they want their contributions to go directly to programming to make a larger impact. By revealing how much money you allocate to overhead expenses, you can show how these funds are necessary to continue your operations and services. Alternatively, some organizations have major donors who might be willing to contribute to the cost of all overhead expenses, so this document is a great way to demonstrate this need.

- Ensure spending aligns with your mission and strategic goals. Your board is responsible for approving your nonprofit’s annual budget to ensure it aligns with your strategic priorities. Share your Statement of Functional Expenses with them and include it in your final nonprofit board report of the year so they can verify you’ve allocated funds appropriately.

Internally, your Statement of Functional Expenses allows you to assess the accuracy of your financial reporting. Since this statement and your Statement of Activities include a total expenses category, make sure these match up on both documents.

Sharing financial data with your stakeholders via your nonprofit’s financial statements shows you are committed to continued transparency and building honest, long-lasting relationships with your supporters. Work with a nonprofit accounting firm to ensure you complete these statements correctly, and consider accompanying them with data visualizations to highlight important data points in an easily digestible format.