Ensuring your nonprofit is ready for the upcoming tax season or fiscal year requires more than occasional check-ins. To operate efficiently, you must consistently manage and organize your finances. Missing your tax-filing deadlines can significantly cost your nonprofit in lost supporter relationships and IRS fines. Most of all, you could even lose your tax-exempt status, which critically motivates donors to give and allows you to retain more of the funding needed to achieve your mission.

However, by understanding how to file nonprofit taxes on time, you can retain tax revenue, maintain supporter relationships, and ensure your long-term success. Let’s explore three key benefits of filing your taxes and how to streamline the process yearly.

1. Retain your 501(c)(3) status.

Filing your organization’s annual tax returns also allows you to retain your official status as a registered 501(c)(3) nonprofit, which comes with the following benefits:

- Tax-exemption: Registered 501(c)(3) organizations are exempt from federal taxes as well as many sales, property, and state income taxes, which allows them to retain as much of their hard-earned funding as possible. Without this official designation, your organization will be responsible for the taxes expected from for-profit institutions.

- Tax-deductible donations: Claiming charitable donations as tax deductions is a major perk for philanthropic taxpayers. While it’s possible to fundraise and operate as a charitable organization without being registered as a 501(c)(3) nonprofit, it’s significantly easier to do so with that designation in hand. This way, donors will trust the authority of your organization, and they can claim their donations on their annual tax filings!

- Grant eligibility: Grant funding—whether from corporations, government agencies, or private grantmaking foundations—can supplement contributions from individual donors. These organizations usually mandate that applicants have 501(c)(3) status to be eligible for certain grants to ensure their resources go to reputable causes.

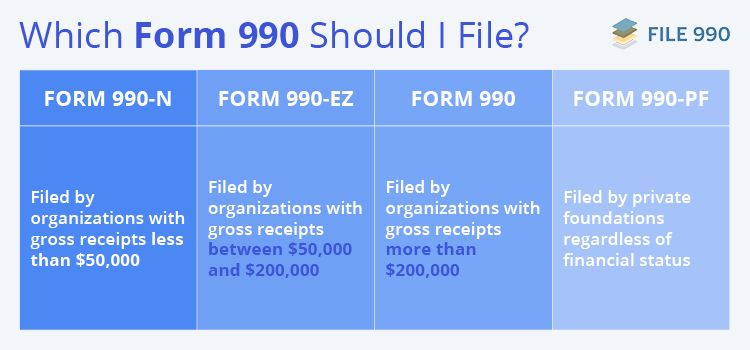

To receive a 501(c)(3) designation initially, a nonprofit must submit Form 1023 with the IRS. You’ll need to file your Form 990 every year to retain the status, which comes in the following types:

- Form 990-N, which is filed by organizations with gross receipts less than $50,000

- Form 990-EZ, which is filed by organizations with gross receipts between $50,000 and $250,000

- Form 990, which is filed by organizations with gross receipts of more than $200,000

- Form 990-PF, which is filed by private foundations regardless of financial status

Failing to file your annual Form 990 for three consecutive years can cause an organization to lose its status as a 501(c)(3) nonprofit. If you lose your nonprofit status, not only will you have to go through the extensive and time-consuming process of re-filing again, but you’ll also have to repay the associated fees. It’s much easier to just retain your status by filing your Form 990 every year.

2. Avoid substantial fines.

Losing your tax-exempt status isn’t the only financial penalty you receive for neglecting your tax returns. The IRS can and will fine late nonprofits at least $20 per day until they submit it, which can snowball quickly.

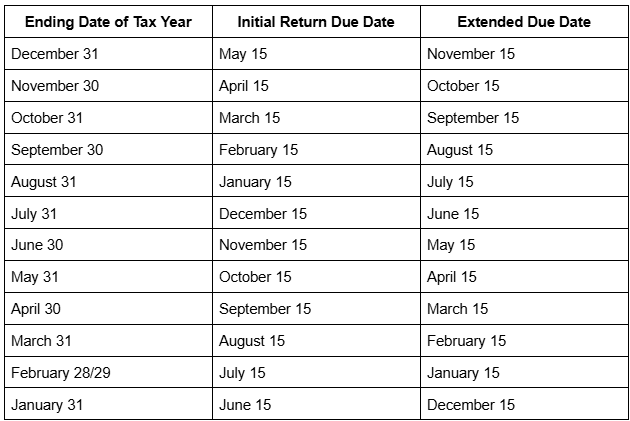

Each nonprofit’s due date is different based on the end of their fiscal year, but an easy rule of thumb is that it’s the 15th day of the fifth month after the end of your fiscal year. Use this table from File 990 to double-check your dates:

Be sure to complete your returns completely and accurately, starting with choosing the right version of the Form 990. An incomplete or otherwise inaccurate tax form will not count as submitting your return on time and can result in the same penalties as failing to file.

Avoid these fines by filing for an extension on your annual tax forms. If you notice your organization’s deadline is quickly approaching and foresee missing your deadline, consider filing Form 8868 for a six-month extension.

3. Prioritizes transparency with donors.

DonorSearch stresses that donors need to know before they decide to give that their contributions will support a worthy cause and nonprofit. So, nonprofits must remain transparent with donors about how they use contributions to secure long-term support.

But how can nonprofits be transparent about their finances without revealing confidential information? That’s where Form 990 comes in. This form simplifies sharing financial impact metrics, such as expenses, revenue, and staff salaries. As public-facing government documents, tax forms let donors know how you manage donations without breaching their privacy.

Your nonprofit’s finances are crucial in ensuring its overall health, longevity, and success. By completing your annual tax return, you’re one step closer to avoiding significant fines, retaining your status as a registered nonprofit, and maintaining trust with supporters.

Plus, filing your taxes doesn’t have to be difficult. When you invest in the right Form 990 software, you can save on an accountant, get notified when a deadline is approaching, and submit forms straight to the IRS, mitigating extra expenses and the risks of snail mail. Using these tools and maintaining great financial management habits year-round will set your organization up for continued financial success. That being said, if you know your financial management needs work, don’t wait to put new practices into place—there’s never a better time to start improving than right now!