Starting a new nonprofit is a rewarding yet laborious process. From defining your mission to building your board of directors to securing initial funding, you’ll put in a lot of hard work to get your organization up and running.

Amid all the chaos of this new endeavor, don’t forget about financial management and regulatory compliance, which involves compiling accurate nonprofit financial statements and filing IRS Form 990 each year. Form 990 is an annual tax form that most nonprofits must complete to maintain tax-exempt status.

While the Form 990 process can seem daunting at first, learning more about the form and how to fill it out will help prepare you for it. In this guide, we’ll answer some common Form 990 questions and offer tips to set you up for success.

Why does Form 990 matter?

In addition to maintaining compliance and tax-exempt status, filing Form 990 is important because it allows you to:

- Build trust with stakeholders. Form 990 includes financial statements, which showcase your financial position and fiscal stewardship. Proving that your nonprofit uses funds responsibly can establish a foundation of trust with donors, sponsors, and other external stakeholders, allowing you to retain their support.

- Showcase your work. Form 990 also includes space to highlight your organization’s successes and mission fulfillment. This information will help current and potential funders feel confident in your ability to achieve meaningful impact and be more inclined to continue contributing.

- Improve your reputation. Nonprofit watchdog groups like Charity Navigator and foundations often use Form 990 as a way to evaluate nonprofits. If you complete this form clearly, completely, and accurately, you may receive higher ratings, making it easier to secure grants, community partnerships, and other funding opportunities.

Form 990 is more than just an IRS-required form. It’s an opportunity for your nonprofit to share its mission-driven work and responsible financial stewardship with stakeholders.

Which Form 990 version should I file?

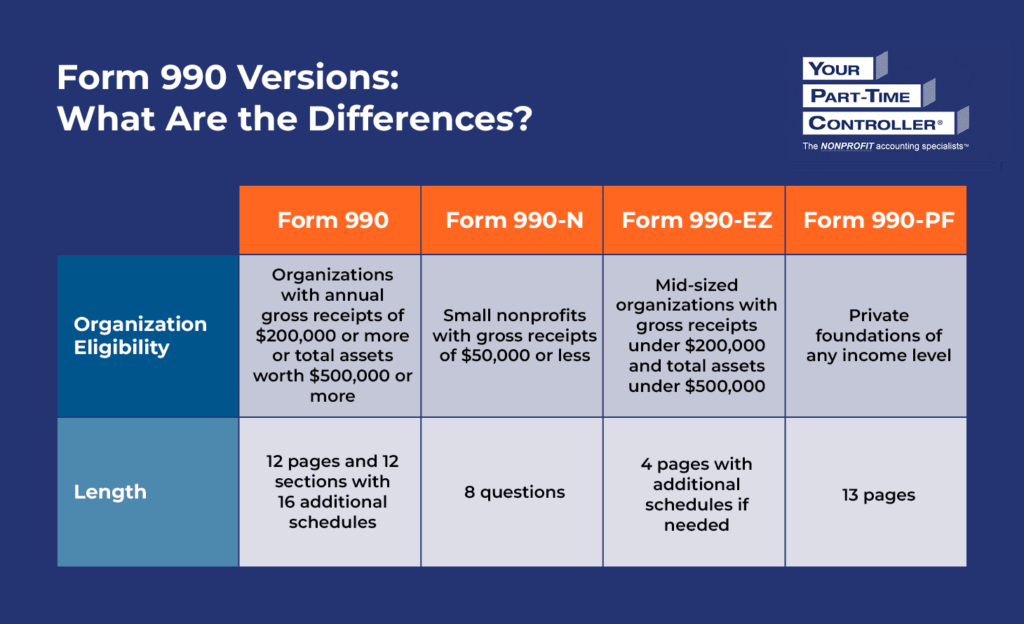

There are several different versions of Form 990 depending on your nonprofit’s size, type, and income. YPTC’s nonprofit financial management guide explains the following distinctions between each version:

- Form 990. The standard version of Form 990 is for organizations with annual gross receipts of $200,000 or more or total assets worth $500,000 or more. The form is 12 pages long and contains 12 sections with 16 additional schedules that can increase the length. For example, Schedule D enables you to report on donor-advised funds (DAFs), conservation easements, certain art and museum collections, escrow or custodial accounts or arrangements, endowment funds, or any other supplemental financial information.

- Form 990-N. This shorter version of the form is for small nonprofits with gross receipts of $50,000 or less. It only includes eight questions to obtain the following pieces of information: your organization’s employer identification number (EIN), tax year, legal name and mailing address, any other organizational names, principal officer name and address, website, confirmation that your nonprofit’s annual gross receipts are $50,000 or less, and, if applicable, a statement that your organization has terminated or is terminating.

- Form 990-EZ. This version of Form 990 is for mid-sized organizations with gross receipts under $200,000 and total assets under $500,000. It’s typically four pages long, but there are several additional schedules that may be required.

- Form 990-PF. Lastly, Form 990-PF is for private foundations, regardless of income. It is 13 pages long and requires eligible organizations to report information like grantmaking activities and recipients, investments, offers, assets, and excise tax calculations.

Once you’ve determined which version of the form is right for your nonprofit, you can find it on the IRS website, along with any additional schedules you may need.

When is the Form 990 deadline?

After selecting the correct version of the form, you must file Form 990 by the 15th day of the fifth month after your nonprofit’s fiscal year ends. If your fiscal year aligns with the calendar year, you must file by May 15th.

If you need an extension, you can file Form 8868 to request six additional months. However, it’s best to prepare well in advance and file Form 990 on time, or you may be subject to penalties.

For organizations with gross receipts less than $1,208,500 and without reasonable cause for filing late, the IRS will charge $20 per day the return is late, with a maximum penalty of $12,000 or 5% of the organization’s gross receipts, depending on which is less. If your gross receipts are more than $1,208,500, the penalty is $120 per day up to a maximum of $60,000.

5 Common Form 990 Mistakes to Avoid

When doing anything for the first time, you may encounter some difficulties. Filing Form 990 is no different. However, we’ve compiled a list of common mistakes so you can proactively avoid them when completing this process:

- Filing the wrong version. As mentioned above, the version of Form 990 you file depends on your organization’s size, type, and income. While the chart and information presented should help you determine whether your nonprofit should file Form 990, Form 990-N, Form 990-EZ, or Form 990-PF, you can always double-check with your nonprofit accountant to be sure.

- Missing the deadline. Avoid penalties by gathering your financial records early and creating an internal schedule for your team to follow. Set your own benchmarks well in advance of the IRS deadline so you have time to prepare and rectify any mistakes before filing your official Form 990.

- Skipping Schedule O. Schedule O allows you to add supplemental information to Form 990 or Form 990-EZ and expand on your responses to certain questions. This schedule is required for all organizations that file Form 990 and certain organizations that file Form 990-EZ. However, even if your nonprofit doesn’t have to fill Schedule O out, it’s a great chance to fully explain your financials and programs in narrative form. Adding more context helps both the IRS and your stakeholders get a fuller picture of your financial circumstances and program service accomplishments.

- Not reporting in-kind donations correctly. While it’s clear you have to report on all cash your nonprofit receives, you must also report all noncash contributions on Form 990. Include donations of property and goods in the revenue section, and report gifts of services and use of facilities as a reconciling item at the end of the form. The IRS also requires additional paperwork for certain in-kind donation types, including items worth over $25,000, historical artifacts or artwork, and donations worth $500 or more, such as vehicles.

- Ignoring public disclosure requirements. Form 990 is a public document. While anyone can find your organization’s Form 990 using the IRS Tax Exempt Organization Search Tool and websites like Guidestar by Candid, many nonprofits choose to share their Form 990 directly with stakeholders to increase access and transparency. You may attach Form 990 to your annual report and add it to your website.

When you can anticipate potential areas where filing Form 990 may go wrong, you can better prepare your team to approach the process efficiently and effectively. That way, your first time filing Form 990 will go as smoothly as possible, minimizing mistakes and maximizing accuracy.

Don’t let the intricacies of financial compliance hold your new nonprofit back. By better understanding the Form 990 process, you can confidently file your annual return and maintain your tax-exempt status year after year. If you have any additional questions or need help preparing, work with a nonprofit accounting firm.